By Emily McKinley, Health Information Specialist

On January 1, 2014, the Patient Protection and Affordable Care Act (ACA) will be fully implemented. At this time, all Americans must be enrolled in some form of health coverage program to avoid tax penalties. To facilitate purchase and enrollment in health coverage plans, including Medicaid, the Health Insurance Marketplace will open in October 2013. Family Voices encourages individuals to prepare for this transition by educating themselves about the Marketplace, insurance plans, and other relevant changes. To this end, we have shared monthly ACA updates (www.fvindiana.blogspot.com, filter by topic Affordable Care Act) as well as time-sensitive alerts about the legislation. In this update, we would like to share how you can prepare for enrolling via the Health Insurance Marketplace.

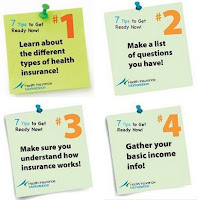

If you are not already familiar with insurance, this is a great time to review coverage terms and costs. We recommend perusing www.healthcare.gov to learn more about basic insurance information, terminology, mandated coverage, and forthcoming changes.

The ACA has mandated that insurance policies be more transparent. In this vein, all plans must now fall under actuarial values that are categorized using the metals platinum, gold, silver, and bronze. Each metal corresponds with a level of coverage and costs associated with the coverage. For example, platinum plans will provide the most comprehensive level of coverage, will carry higher premiums, but will also have lower out-of-pocket costs over the life of the plan. On the other hand, bronze plans will have the least extensive coverage, lower premiums, but higher cost-sharing. All plans must cover preventative care at no additional cost and will include essential health benefits, at varying coverage and cost levels. Before shopping for insurance, consider your family’s budget and typical spending on medical expenses throughout the course of the year. What types of services are you likely to access and with what frequency? How will the copays and deductibles associated with these services impact your overall budget? These considerations should shape your decision with regard to the level of plan you need.

Next, it is important to consider whether continuity of care is important to your family. Purchasing new coverage may cause your family to switch providers. If it is important to stay with current providers, be sure the providers will accept the new plan before you purchase it.

In addition to continuity of care, it is important to consider the family’s lifestyle and needs. Individuals who travel frequently may need a plan with a larger network of providers and/or that has specific provisions for travel. Individuals who require assistive technology or specialized therapies may want to search for a plan that will cover these services. Having a list of questions ready will help focus the search during the shopping and enrollment steps.

Many individuals and families will be eligible for tax credits and/or premium cost-sharing beginning in January. This subsidy calculator developed by the Kaiser Family Foundation gives consumers a good idea of potential tax subsidies. It will be important for families to weigh the benefits of cost-sharing versus a tax credit when purchasing insurance. Where will the family receive the greatest benefit? It is important to note that in order to receive a tax credit, one must file a tax return each year.

On that note, gather information about income prior to accessing the Health Insurance Marketplace. Easily accessible tax documentation and pay stubs will speed up the application process while minimizing the stress. Marketplace enrollment will be available online, by phone, and via paper applications (see an example here).

Ask for assistance if you need it. In addition to greater transparency on the part of insurance providers, the ACA also mandates that each state make “Navigators” available to consumers. Navigators will be state and federally certified individuals who can provide consumers assistance as they are shopping on the Marketplace. These individuals and organizations must be free from biases and conflicts of interests. If you have questions about your insurance needs, the plans available, or simply navigating the Marketplace, use your resources. Speak with a Navigator or consider calling Family Voices for assistance.

If you have questions about information in this update, the Health Insurance Marketplace or other health care needs, please visit www.healthcare.gov or contact Family Voices at 317-944-8982 or info@fvindiana.org.

Comments